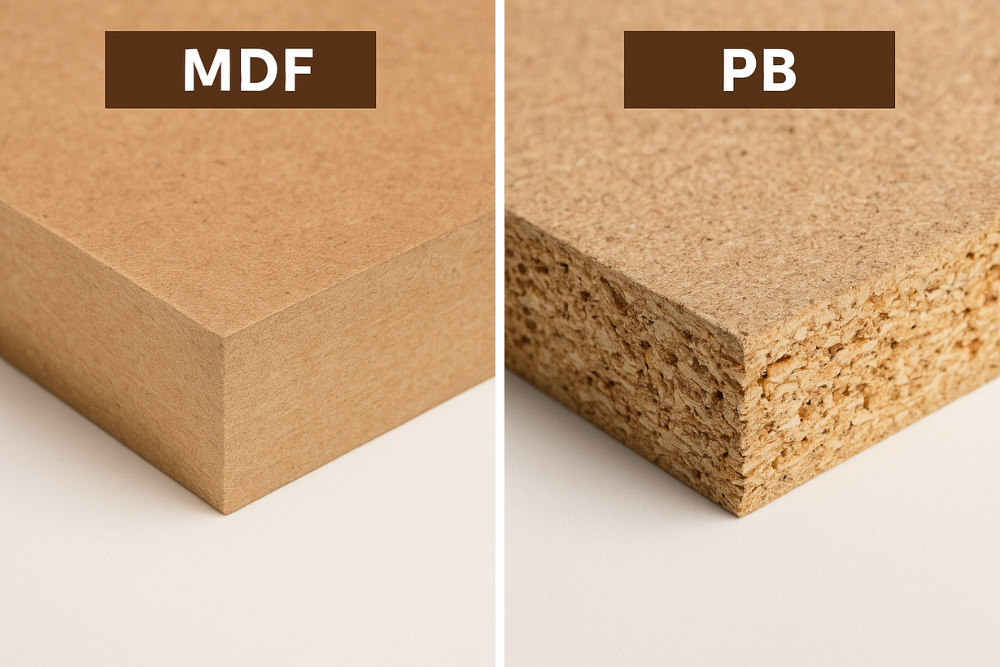

1. What are MDF and PB?

In the furniture and construction industries, engineered wood is widely used for its affordability, versatility, and consistent supply. The two most common types are MDF (Medium Density Fiberboard) and PB (Particle Board).

MDF (Medium Density Fiberboard)

-

Composition: fine wood fibers mixed with resin and additives.

-

Properties: smooth, uniform surface, easy to paint and machine.

-

Advantages: stronger than PB, good screw-holding capacity, less warping.

-

Applications: kitchen cabinets, doors, flat furniture, high-end products.

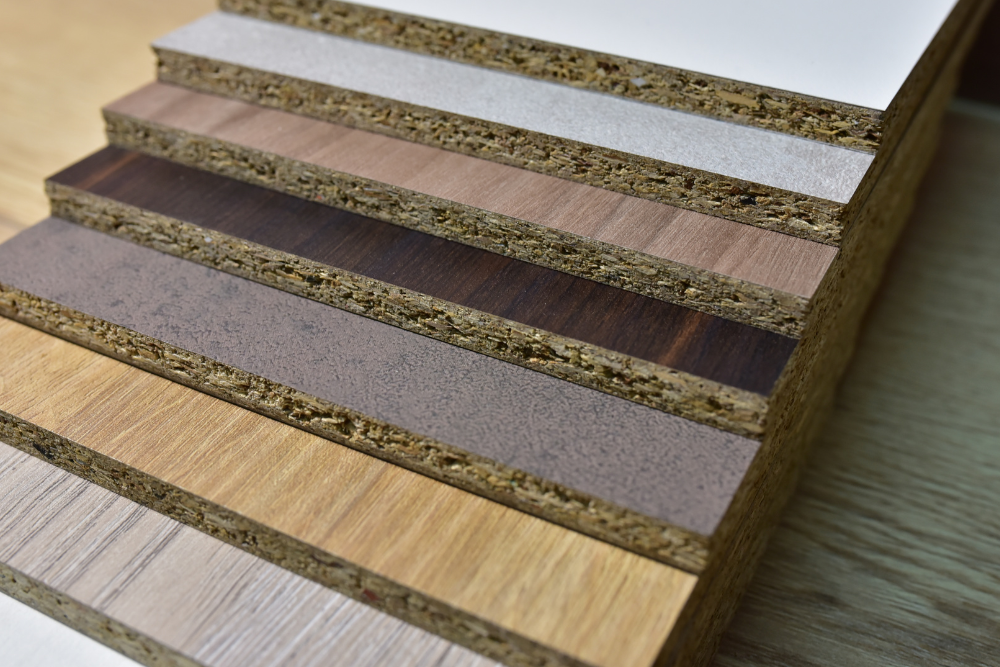

PB (Particle Board)

-

Composition: wood chips mixed with resin and pressed into sheets.

-

Properties: non-uniform texture, lighter, lower cost.

-

Advantages: inexpensive, quick to produce, suitable for budget furniture.

-

Disadvantages: poor screw-holding, low moisture resistance, less durable.

-

Applications: desks, wardrobes, office partitions, low-cost furniture.

👉 Summary: MDF is stronger and smoother, while PB is cheaper and lighter.

2. HS Codes for MDF and PB

When importing, businesses must declare the correct HS code for tax calculation and customs clearance.

-

MDF: Chapter 4411 – Fibreboard of wood or other ligneous materials

-

Common HS codes: 4411.12.xx / 4411.13.xx (depending on thickness and density).

-

-

PB (Particle Board): Chapter 4410 – Particle board, OSB and similar board

-

Common HS codes: 4410.11.xx / 4410.12.xx.

-

3. Import Duties and Policies

-

MFN duty: usually 0% – 5% for MDF and PB.

-

VAT: 8%.

-

Imports from FTA countries (ASEAN, China, Korea, EU, etc.) may enjoy 0% duty with a valid Certificate of Origin (C/O).

4. Import Procedures in Vietnam

Importing MDF and PB is straightforward as they do not require special permits.

Step 1 – Prepare documents

-

Sales contract

-

Commercial invoice

-

Packing list

-

Bill of lading

-

Certificate of Origin (if any)

-

Product catalogue/specifications

Step 2 – Customs declaration

-

Declare via the VNACCS system.

-

Select correct HS code (4410 for PB, 4411 for MDF).

-

Customs inspection (green/yellow/red channel).

Step 3 – Pay taxes and clearance

-

Pay import duty (if applicable) and VAT.

-

Complete clearance procedures.

5. Notes for Importers

-

Choose reliable suppliers to ensure quality.

-

Declare correct HS code to avoid penalties.

-

Check certifications (CARB, E1, E2 formaldehyde emission standards).

-

Leverage FTAs to reduce import costs.

✅ Conclusion

-

MDF: smooth, strong, for mid-to-high-end furniture.

-

PB: cheaper, lighter, for budget furniture.

-

HS Codes: MDF – 4411 / PB – 4410.

-

Importing requires accurate HS declaration, tax payment, and customs clearance.

- EXPORT-IMPORT LICENSE SERVICE

- DLS GLOBAL Proactively Grasps New Regulations on Certificate of Origin and Solutions for Trade Risk Management

- DLS GLOBAL: Forging Comprehensive Supply Chains – Elevating Vietnamese Enterprises to the US Market

- IMPORTANT ANNOUNCEMENT: ENHANCED MANAGEMENT OF GOODS ORIGIN UNDER DIRECTIVE NO. 09/CT-BCT

- 🔥 U.S. Tariffs Hit Timber and Furniture (10–50%) from Oct 14 – A Storm Ahead for Vietnam’s Wood Industry