Dear Valued Partners and Customers,

In the context of increasingly deep international economic integration, a thorough understanding and proper implementation of regulations regarding the origin of goods plays a pivotal role in import-export activities. For Vietnamese enterprises currently exporting or planning to export goods to the United States market, the Certificate of Origin Form B (C/O Form B) is a crucial document that not only confirms the product’s origin but also brings many practical benefits.

This article by DLS GLOBAL will provide a comprehensive overview of C/O Form B for goods exported to the USA, including the application process, necessary documents, criteria for satisfying origin, and important notes that businesses need to be aware of.

1. What is C/O Form B and Why is it Necessary for Exports to the USA?

The C/O Form B (Certificate of Origin Form B) is a legal document issued by the competent authority of the exporting country, certifying the place of production or origin of the goods. In Vietnam, the Vietnam Chamber of Commerce and Industry (VCCI) or organizations authorized by VCCI are the issuing bodies for C/O Form B for exported goods.

Although the United States does not have a direct Free Trade Agreement (FTA) with Vietnam that provides universal tariff preferences, C/O Form B still plays an important role in the following cases:

- Confirmation of Origin: C/O Form B is official proof that the goods originate from Vietnam, helping to enhance the credibility and transparency of the products.

- Compliance with U.S. Customs Regulations: In some cases, U.S. Customs and Border Protection (CBP) may require C/O Form B to verify origin, ensure compliance with import regulations, and prevent trade fraud.

- Benefiting from Special Programs or Trade Remedies: When the U.S. applies trade remedy measures (e.g., anti-dumping, anti-subsidy), C/O Form B can help businesses prove the origin of their products, thereby protecting their export interests.

- Facilitating the Customs Clearance Process: A complete and valid set of documents, including C/O Form B, will help the customs clearance process proceed more quickly and smoothly.

2. C/O Form B Application Process (in Vietnam)

The process for applying for C/O Form B typically involves the following steps:

- Register an account on VCCI’s COMIS system: Businesses need to access the VCCI website or the COMIS system and register an online account.

- Prepare the dossier: Collect and prepare all necessary documents as required (detailed in section 3).

- Submit the dossier: Submit the dossier online via the COMIS system or submit hard copies at the VCCI headquarters or authorized branches/organizations.

- Dossier appraisal: The C/O issuing authority will appraise the completeness and validity of the dossier. During this process, businesses may be asked to provide additional information or documents.

- Issuance of C/O: If the dossier meets all requirements, C/O Form B will be issued. The issuance time is usually 1-2 working days from when the complete dossier is approved.

- Receive C/O: Businesses can receive the original C/O at the issuing authority or via postal service (depending on the chosen option).

3. Necessary Documents for C/O Form B Application

To ensure a smooth C/O Form B application process, businesses need to prepare the following documents fully:

- Application form for C/O Form B: According to the form provided by VCCI or the authorized organization, with complete and accurate information.

- Customs declaration: A copy stamped “Certified True Copy” by the enterprise.

- Commercial Invoice: A copy stamped “Certified True Copy” by the enterprise.

- Bill of Lading or Air Waybill: A copy stamped “Certified True Copy” by the enterprise.

- Packing List: A copy stamped “Certified True Copy” by the enterprise.

- Explanation of the production process: A copy stamped “Certified True Copy” with a detailed description of the product manufacturing process.

- Bill of materials: A copy stamped “Certified True Copy,” showing the proportion of input materials that constitute the product.

- Sales contract: A copy stamped “Certified True Copy” (may be required in some cases).

- Other documents: Depending on the specific requirements of the C/O issuing authority, additional documents such as raw material purchase invoices, export licenses (if any), product samples, product images, etc., may be required.

- C/O Form B record sheet: According to VCCI’s form.

- C/O Form B template: Fully completed.

4. Criteria for Satisfying C/O Form B Rules of Origin

Goods exported from Vietnam to the USA need to meet one of the following non-preferential rules of origin criteria:

- Wholly Obtained (WO): Goods that are entirely produced, grown, or extracted in Vietnam (e.g., mined minerals, harvested agricultural products, animals born and raised in Vietnam, etc.).

- Non-Wholly Obtained: Goods manufactured in Vietnam from materials that may originate from other countries, but must meet one of the following criteria:

- Change in Tariff Classification (CTC): Non-originating materials have undergone a production process that resulted in a change in the Harmonized System (HS) code at a certain level (chapter, heading, subheading, tariff line). The required level of change will vary depending on the product.

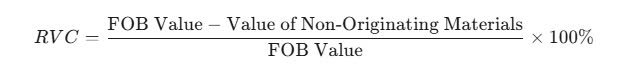

- Regional Value Content (RVC): The value of originating materials from Vietnam plus the production costs incurred in Vietnam must reach a certain percentage of the FOB (Free on Board) value of the final product. Important Note: The specific RVC percentage will vary depending on the specific goods, and there is no common percentage applicable to all products. Businesses need to determine the HS code of their product to obtain detailed information. The RVC calculation formula is usually:

- Product Specific Rules (PSR): For some specific goods, there may be separate rules of origin that specifically regulate the production process or the proportion of originating materials used, instead of applying the usual CTC or RVC criteria.

5. Important Notes When Applying for C/O Form B for Goods Exported to the USA

To ensure a smooth C/O Form B application process and avoid any arising issues, businesses should note the following points:

- Accuracy and Consistency of Information: All information on the C/O and related documents must be declared accurately and consistently.

- Understanding the Rules of Origin: Businesses need to thoroughly understand the rules of origin criteria for each specific type of goods to ensure their products meet the requirements.

- Complete and Careful Dossier Preparation: Missing documents can lead to the return of the dossier or prolong the C/O issuance time.

- Application Submission Time: It is advisable to submit the C/O application early, avoiding the delivery date, to allow sufficient processing time if any issues arise.

- Updating New Regulations: Regulations related to C/O may change over time; businesses need to regularly update information from VCCI or official sources.

- Consulting Experts: If you have any questions or complex issues, do not hesitate to contact import-export consulting experts or directly contact VCCI for assistance.

DLS GLOBAL – Your Companion in Exporting

With extensive experience in logistics and customs procedures, DLS GLOBAL is always ready to assist your business in preparing documents and applying for C/O Form B quickly and efficiently. We are committed to providing professional and dedicated service, helping your business optimize export activities to the United States market.

Contact DLS GLOBAL today for detailed consultation and the best support!